While many countries around the world grapple with the role of digital currencies and other assets in the financial system – including whether to adopt or reject Central Bank Digital Currencies (CBDCs) – the Reserve Bank of Australia (RBA) has expressed its openness to the tokenization of assets.

In a recent speech, Brad Jones, Assistant Governor (Financial System) at the RBA, outlined several key points that highlight its position on the possibilities of incorporating tokenization into its strategic work program on the future of money.

Key Takeaways

- The Reserve Bank of Australia (RBA) is open to the idea of incorporating asset tokenization into its strategic work program on the future of money, recognizing the historical evolution of monetary systems and the importance of trust and credibility in public money.

- RBA sees tokenized assets can offer benefits such as increased liquidity, transparency, auditability, shorter settlement cycles, and reduced intermediary and compliance costs in financial markets.

- RBA views CBDCs as a potential solution to enhance the financial system, complementing privately issued digital money like tokenized bank deposits and asset-backed stablecoins rather than replacing them.

Lessons From Financial History

From a historical perspective, the RBA acknowledges the co-dependence of commercial and monetary arrangements in the financial system. In the past, commercial activity has sometimes come up against the constraints of the existing monetary system before new technologies enabled the monetary system to adapt and accommodate new forms of exchange, Jones said.

For instance, the invention of paper money centuries ago facilitated trade across continents without the constraints of transporting heavy coins and metals, while new forms of money, like bills of exchange and new types of financial infrastructure, accompanied the Industrial Revolution. More recently, the digitalization of paper assets and ledgers has created new efficiencies and forms of asset trading.

An important lesson to draw from history is the challenge of private money filling the void when public money does not evolve to support new forms of commercial activity – with mixed results. This highlights the importance of trust, confidence and credibility in the value of money to ensure the public’s willingness to exchange it.

Jones noted:

“Private issuers have sought to bridge this trust deficit by fully collateralizing the money they issue and/or by subjecting themselves to regulation and supervision. Unbacked cryptocurrencies issued outside the regulatory perimeter have tried to buck this pattern, without success.”

The current two-tier monetary system comprising a national central bank and multiple commercial banks works as it combines the best features of public and private money with the separation of responsibilities between the public and private sectors.

A stable and reputable central bank provides a foundational level of trust in the value of public money and promotes competition in the financial system by providing a base infrastructure on which private institutions can operate and innovate.

“As we contemplate how our monetary and financial arrangements might evolve in the years ahead, my sense is that our efforts should be concentrated more on uplifting than replacing the two-tier system. And this is where tokenization comes in.”

Benefits and Challenges of Asset Tokenization

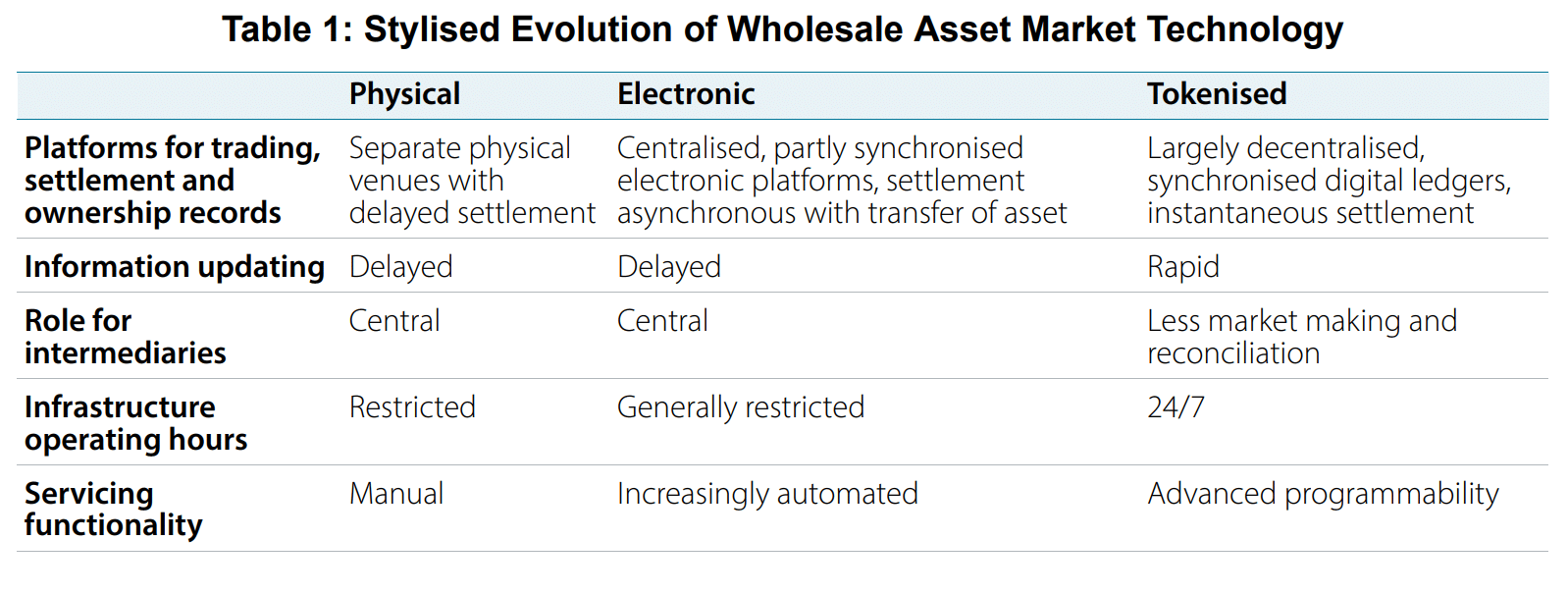

In their simplest form, tokenized assets are digital bearer instruments that represent claims on underlying assets that exist in the traditional financial world. However, as well as ownership rights, they contain unique information that can be updated instantly and can be programmed via smart contracts to perform functions beyond traditional finance. Tokens can be exchanged bilaterally around the clock on decentralized public or private ledgers.

The RBA recognizes that the role of intermediaries would likely evolve in a tokenized financial ecosystem, as there would be less need for market-making activity and manual reconciliation of records. The full potential of tokenization requires assets and money to exist on the same ledger for simultaneous post-trade payment settlement and updating of ownership records in real-time, but separate, synchronized platforms could still be effective, Jones stated.

“The threshold policy question is what potential benefits could tokenization crystalize, and are the downsides manageable? These issues need to be understood in the context of the frictions and risks in our current system, and with the recognition that they could unfold differently in different markets,” Jones said.

Some of the potential benefits of tokenization include:

- Increased liquidity and transparency: More timely and complete information provided through digital tokens could help to complete markets and boost economic efficiency. For instance, pricing in Australia’s $750 billion bank term deposit market, which accounts for around 15% of the country’s bank funding, has changed little in the past 25 years and is still largely conducted over the phone, in branches, by email, and on spreadsheets. Tokenization could help to automate and increase the efficiency of this process.

- Increased auditability: Enhanced auditability could spur activity in developing asset markets such as carbon credits or green bonds, where data needs to be verifiable in real time to enhance trust. In general, the combination of transparency, lower barriers to entry from direct access to markets, fractional ownership and 24/7 transactions and settlements could increase liquidity by lowering the cost of capital and opening up access for borrowers.

- Shorter settlement cycles: Eliminating delays between trade execution and settlement could free up collateral and reduce counterparty, operational and market risks.

- Reduced intermediary and compliance costs: The ability to program tokens can reduce manual entries in trade processes. For instance, the securitization market can involve up to 12 intermediaries, making fixed-income markets ripe for disruption.In cross-border payments, bank fees comprise a large share of the 5-7% average cost of sending remittances. Programming asset tokens could also help to increase efficiency and reduce costs in compliance checks and asset servicing, including the calculation and payment of interest and the conditional rebalancing of asset portfolios.

An example of the growing global interest in tokenization is the issuance of around $4 billion in tokenized bonds in recent years. Official institutions, including the European Investment Bank, the Central Bank of Thailand, Hong Kong, and local Swiss and US government entities, have accounted for more than half of this issuance.

RBA scenarios estimate that tokenization in Australian financial markets could bring hypothetical transaction cost savings of $1-4 billion per year – driven by tighter bid-ask spreads reflecting increased trading volumes and gains from instant settlement driving down other costs.

The hypothetical cost of capital savings could reach as much as $13 billion per year.

However, some of the challenges of tokenization include:

- Regulatory uncertainty and compliance obligations: Regulators globally face a challenge in supporting innovation while ensuring financial stability and consumer protection. The nature of smart contracts on blockchain networks raises questions as to accountability. Only a few jurisdictions have established new regulatory frameworks for tokenized asset markets, while others have taken the view that tokenized finance should operate within existing regulatory frameworks. Australia is currently working on a regulatory framework led by the Treasury, with support from the Council of Financial Regulators.

- Interoperability: Tokenized asset markets will need to be interoperable with traditional infrastructure, as participants will need time and money to implement new systems, and some institutions may opt not to do so. Communication between on-chain and off-chain technologies will be vital to limiting fragmentation between assets traded across different venues.

- The impact on transaction liquidity: Trades and orders would need to be pre-funded in a system with instant settlement, increasing liquidity requirements for market participants. In markets where intermediaries contribute significantly to traded volumes, this could lead to market makers showing less competitive prices and widening bid-ask spreads. The fragmentation of trading volumes between decentralized platforms and traditional financial infrastructure could also reduce liquidity.

These challenges may be overcome, but policymakers and industry will need to work together to make this possible.

The Future of Money in Asset Tokenization

Although tokenized asset transactions could settle in traditional money, this would reduce some of the efficiency benefits. The RBA sees tokenized money as potentially facilitating more of the benefits but sees limited roles for unbacked cryptocurrencies, tokenized bank deposits and asset-backed stablecoins.

Cryptocurrencies like Bitcoin (BTC) are fundamentally unsuitable owing to a lack of trust, oversight, asset-backing, and their wild price volatility, which has made them more like speculative investments than safe settlement instruments, Jones said.

Limited fungibility, scalability issues and high transaction costs also make them unsuitable as a medium of exchange.

“It’s possible that unbacked cryptocurrencies remain a hotbed of speculative interest, but I struggle to envisage them playing an expansive role in the financial system of the future.”

Stablecoins issued by well-regulated financial institutions and backed by high-quality assets such as government securities and central bank reserves could be widely used to settle tokenized transactions. However, there are risks that non-backed stablecoins issued by non-banks would be considered less valuable and trustworthy.

The RBA sees a wholesale CBDC as a potential solution, as it could offer advantages such as credit and liquidity risk-free transactions, potentially spurring innovation and serving as an anchor for the financial system.

“As a wholesale CBDC would simply represent an advanced form of central bank money that has underpinned the Australian financial system for decades, this would represent an evolution in the two-tier monetary system – not a revolution.

“Though there are many issues still to resolve, these are some of the reasons why the Bank, and many of our international peers, are actively examining the case for wholesale CBDC,”

The RBA views a wholesale CBDC as a complement to new forms of privately issued digital money, such as tokenized bank deposits and asset-backed stablecoins, rather than a substitute.

The central bank’s recent CBDC pilot project highlighted opportunities for CBDC-enabled settlement to enhance the way established financial markets operate or facilitate the development of new asset markets.

The pilot also indicated that further research will be required to better understand operational design issues for new forms of ledgers, including scalability and throughput, as well as interoperability between on-chain and off-chain ledgers.

And it emphasized the importance of a modern regulatory framework to support innovation in digital financial services while protecting financial stability.

The RBA acknowledges the possibility that a CBDC might not be necessary at all in a modernized financial infrastructure. But its “overarching position is that we remain open-minded about the functional forms of digital money and supporting infrastructure that could best support the Australian economy in the future.”

The Bottom Line

The Australian central bank is in the early stages of planning for a new project assessing how different forms of digital money and infrastructure could support the development of tokenized asset markets in the country. It has made the question of how the Australian monetary system can best support the country’s economy in the digital age “a key priority”.

The RBA acknowledges the challenges posed by regulatory uncertainty, interoperability, and transactional liquidity in asset tokenization, but its open approach makes it a leader in exploring the potential benefits of tokenized exchange and CBDCs.