What is the Nasdaq-100 Index?

The Nasdaq-100 Index is a stock market index made up of the 100 largest domestic and international non-financial companies listed on the Nasdaq stock exchange based on their market capitalization.

It contains major technology and consumer discretionary companies, and it is considered a key benchmark for the technology sector.

Overview of the Nasdaq-100

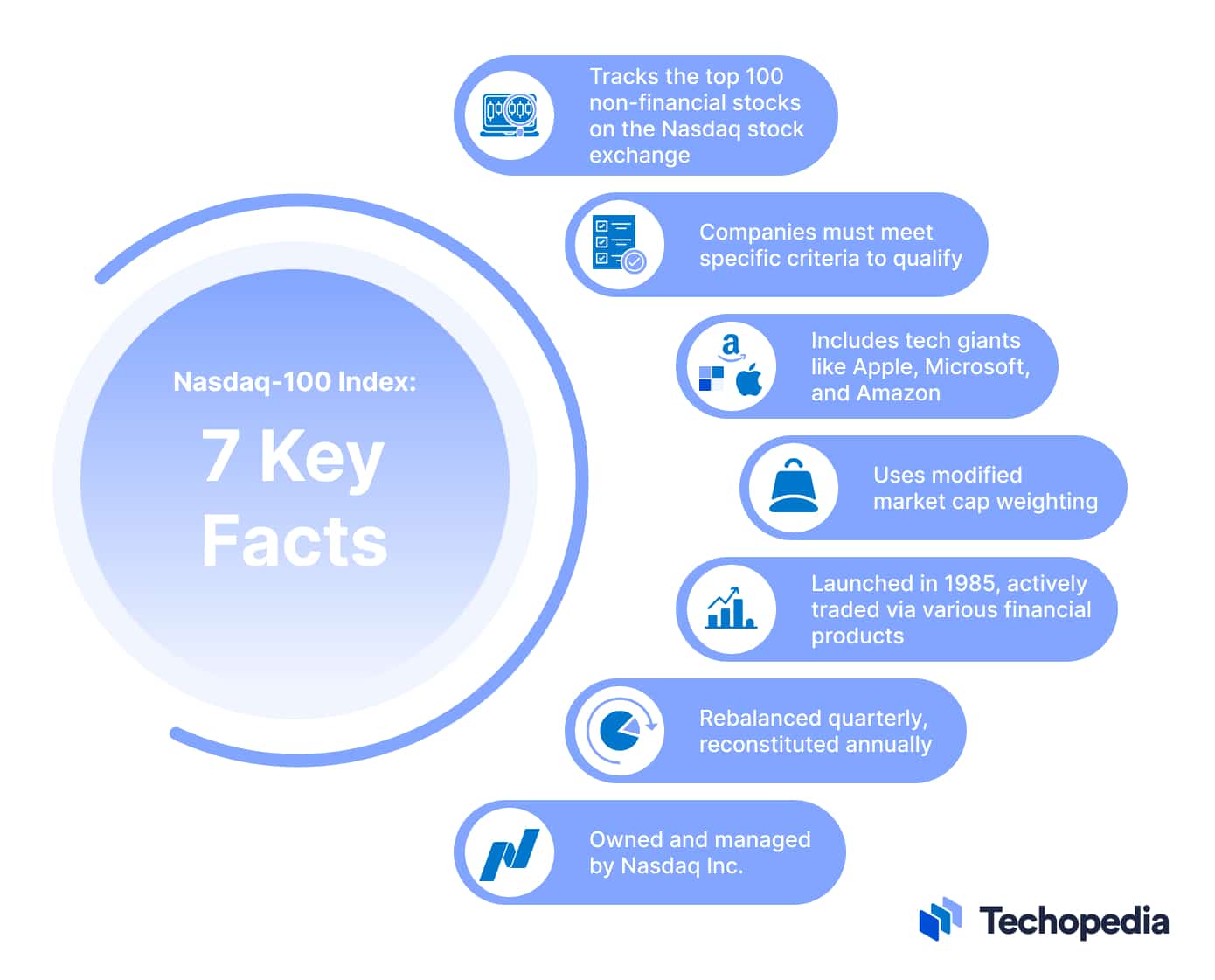

The following is a summary of multiple key details about the Nasdaq-100 Index:

- It tracks the 100 largest non-financial stocks listed on the Nasdaq stock exchange.

- To qualify, companies must meet minimum trading volume, public float, and other eligibility criteria.

- The index includes leading companies across major industry groups like technology, retail, healthcare, biotechnology, industrial, and telecommunications. Real estate investment trusts (REITs) are not eligible to be included in the index.

- Major components include big technology names like Apple, Microsoft, Amazon, Alphabet, Meta, and Tesla.

- The index uses a modified market capitalization weighting methodology with caps on individual stock weights.

- It was launched in 1985, and it is now widely traded through options, futures, ETFs, and other financial products.

- The index is rebalanced quarterly and reconstituted annually to account for changes that component stocks experience during those periods.

- The index is owned, managed, and published by Nasdaq Inc.

Composition of the Nasdaq-100

The index includes different types of securities, including common shares and American Depositary Receipts (ADRs) for foreign stocks. Companies must have an average daily trading volume of at least 200,000 shares to be considered.

Here is the industry breakdown for the Nasdaq-100 as of October 2023:

Sector

Allocation

Technology

58.06%

Consumer Discretionary

18.44%

Health Care

6.95%

Telecommunications

5.38%

Consumer Staples

3.84%

Industrials

4.81%

Utilities

1.26%

Energy

0.7%

Basic Materials

0.29%

Real Estate

0.28%

Meanwhile, as of September 2023, the following individual stocks have the highest weightings within the Nasdaq-100 Index:

Company

Allocation

Apple

10.8%

Microsoft Corp

9.5%

Amazon

5.3%

NVIDIA Corporation

4.3%

Meta Platforms

3.8%

Tesla

3.2%

Alphabet Class A

3.1%

Alphabet Class C

3.1%

Broadcom

3%

Costco Wholesale

2.2%

As of this same date, a total of 101 components make up the Nasdaq-100. The index is heavily weighted towards the technology sector, reflecting the strong representation of tech companies in the Nasdaq exchange.

The consumer discretionary, healthcare, and communications sectors also have notable weightings. Stocks must meet liquidity and other eligibility criteria to be included.

Calculating the Nasdaq- 100 Index

The Nasdaq-100 Index uses a modified market capitalization weighting methodology. Rather than straight market-cap weighting, the index applies a capping system to avoid over-concentration in the largest companies.

The capping rules are:

- No single stock can exceed 24% of the total index weight.

- The cumulative weight of all stocks over 4.5% cannot exceed 48% of the total index.

Additionally, if a company has multiple share classes, they are all included separately, provided that they meet the eligibility criteria.

The exact index value is calculated by following these steps:

- Determining the market cap of each component stock.

- Adjusting the market cap weights based on the capping rules.

- Multiplying the adjusted weights by the component stock prices.

- Summing the weighted stock prices.

- Dividing the total by the index divisor.

The divisor helps maintain the continuity of the index over time when new components are added, or some existing ones are eliminated and adjusted for corporate actions.

Nasdaq-100 Weighting Example for a New Component

The Nasdaq -100 uses a modified market capitalization weighting methodology to determine component weights. When a new stock is added to the index, its weight is calculated based on its market cap relative to the total market cap of the index.

However, weighting caps are applied to avoid over-concentration in the largest companies:

- Individual stocks cannot exceed 24% of the total index weight.

- Stocks with over 4.5% weight cannot collectively exceed 48%.

For example, let’s assume that the Nasdaq-100 has an existing total market cap of $5 trillion.

A new stock, Stock A, is being added with the following details:

Stock A Market Cap – $500 billion

Share Price – $100

The initial market cap weight of Stock A would be:

Stock A Market Cap / Total Index Market Cap = $500 billion / $5 trillion = 10%

However, since this exceeds 4.5%, the weight needs to be capped to ensure the cumulative weight of stocks over 4.5% remains under 48%.

The new stock’s final capped weight would be adjusted lower accordingly. The exact weight would depend on the distribution of weights for the existing components.

This demonstrates how the Nasdaq-100 indexing rules limit the influence of large new additions to maintain diversification and limit concentration risk. The new stock’s weight is constrained by this indexing methodology.

How to Invest in the Nasdaq-100 Index

Since the Nasdaq-100 Index is not a tradable asset itself, investors use the following vehicles and approaches to gain exposure to the benchmark:

- Purchase the Underlying Stocks: Investors can buy shares of the individual companies that constitute the index and manually calculate how many stocks of each they would need to buy to match the index’s weights. This requires frequent rebalancing, and it is the most difficult way to mimic the performance of the Nasdaq-100.

- Invest in Index ETFs: Many exchange-traded funds track the Nasdaq-100 Index, such as the Invesco QQQ ETF (QQQ) – the most popular of all – and the Global X Nasdaq-100 Risk-Managed Income ETF (NQRMII).

- Trade Options and Futures: Investors can trade Nasdaq-100 options and futures contracts to speculate on index price movements.

- Nasdaq-100 Mutual Funds: Some mutual funds are designed to closely track the Nasdaq-100 companies and weightings. One of the most prominent examples is the Victory Nasdaq-100 Index Fund (USNQX) from Fidelity Investments.

For most individual investors, investing in a Nasdaq-100 ETF offers a simple way to gain diversified exposure to the major non-financial stocks listed on the Nasdaq.

The popularity of the index has led to a proliferation of Nasdaq-100 financial products over the years.

Nasdaq-100 vs. Other Major Indexes

The Nasdaq-100 is different from other major market indexes. Here’s a summary of what makes this index unique compared to other well-established benchmarks:

- S&P 500: The S&P 500 contains 500 large U.S. companies across all sectors, including financials. The Nasdaq-100 focuses on non-financial companies listed on the Nasdaq exchange.

- Dow Jones: The Dow Jones Industrial Average contains only 30 large U.S. companies weighted by stock price. The Nasdaq-100 uses market-cap weighting and covers 100 companies, primarily in the technology space.

- Russell 2000: The Russell 2000 Index tracks 2000 small-cap U.S. stocks while the Nasdaq-100 tracks mega and large-cap companies.

- Nikkei 225: Japan’s Nikkei 225 Index is more similar to the Dow Jones Industrial Average with a price-weighted methodology and focuses on large blue chip stocks.